Chipotle’s Business Model and Performance: Chipotle Stock

Chipotle Mexican Grill, a leading fast-casual restaurant chain, has built a successful business model based on its focus on fresh, high-quality ingredients, customizable menu, and commitment to sustainable sourcing practices. This has enabled the company to achieve consistent revenue growth and profitability, positioning it as a strong competitor in the fast-casual dining industry.

Chipotle’s Business Model

Chipotle’s business model revolves around offering a limited but customizable menu of fresh, high-quality ingredients prepared in-house. The company’s menu consists primarily of burritos, bowls, tacos, and salads, all made with a variety of proteins, vegetables, and toppings. Customers can choose their own ingredients, creating a personalized dining experience. Chipotle’s focus on fresh ingredients and sustainable sourcing practices is a key differentiator in the fast-casual dining market. The company sources its ingredients from farms and suppliers that meet its strict quality and sustainability standards. This commitment to sourcing practices has helped Chipotle build a strong brand reputation and attract a loyal customer base.

Restaurant Operations

Chipotle’s restaurant operations are designed to be efficient and customer-focused. The company’s restaurants feature a simple and streamlined layout, with open kitchens that allow customers to see their food being prepared. This transparency builds trust and reinforces Chipotle’s commitment to fresh ingredients. Chipotle’s employees are trained to provide fast and friendly service, ensuring a positive customer experience. The company’s focus on operational efficiency has helped it to achieve high levels of productivity and profitability.

Recent Financial Performance

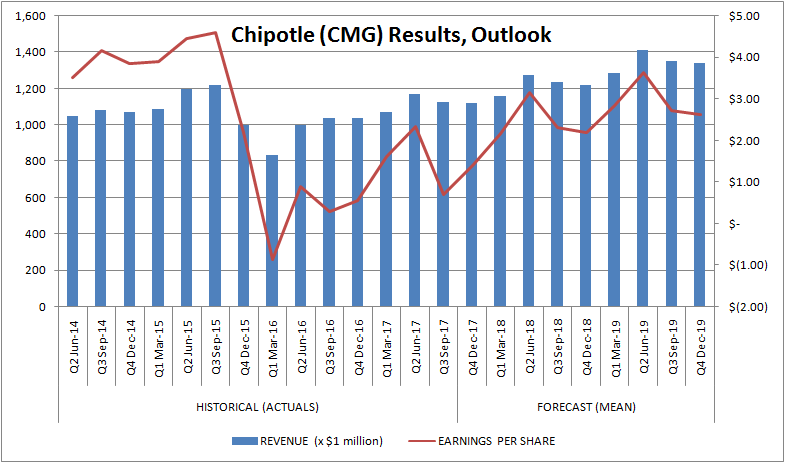

Chipotle has consistently delivered strong financial performance in recent years. The company’s revenue has grown steadily, driven by new restaurant openings and increased customer demand. Chipotle’s profitability has also been strong, with the company generating significant operating margins. Some key financial metrics that highlight Chipotle’s strong performance include:

- Revenue Growth: Chipotle’s revenue has grown at a compound annual growth rate (CAGR) of over 10% in recent years. This growth has been driven by both new restaurant openings and same-store sales growth.

- Profitability: Chipotle has consistently generated high operating margins, exceeding those of many of its competitors in the fast-casual dining industry. The company’s strong profitability is a testament to its efficient operations and pricing power.

- Comparable Restaurant Sales: Chipotle’s comparable restaurant sales have been consistently positive, indicating strong customer demand and brand loyalty. The company’s focus on fresh ingredients and customizable menu has helped it to attract and retain customers.

Chipotle’s Performance Compared to Competitors

Chipotle’s performance has been consistently strong compared to its competitors in the fast-casual dining industry. The company’s focus on fresh ingredients, customizable menu, and sustainable sourcing practices has helped it to differentiate itself from its competitors. Chipotle’s financial performance, including revenue growth, profitability, and comparable restaurant sales, has consistently outpaced many of its competitors. The company’s strong brand reputation and loyal customer base have also contributed to its success.

Factors Influencing Chipotle Stock

Chipotle Mexican Grill (CMG) is a popular fast-casual restaurant chain known for its customizable burritos, bowls, and salads. As with any publicly traded company, the stock price of Chipotle is influenced by a variety of factors. Understanding these factors can help investors make informed decisions about buying, selling, or holding CMG stock.

Earnings Reports

Earnings reports are a key driver of Chipotle’s stock price. Investors closely watch the company’s quarterly and annual earnings reports to assess its financial performance. Strong earnings growth, higher revenue, and improved profitability typically lead to positive stock price movements. Conversely, disappointing earnings can result in a decline in the stock price.

Industry Trends, Chipotle stock

The fast-casual restaurant industry is constantly evolving, and Chipotle’s stock price is affected by broader industry trends. For example, increased competition from other fast-casual chains, changes in consumer preferences, and rising food costs can all impact Chipotle’s performance.

Macroeconomic Conditions

The overall health of the economy also plays a role in Chipotle’s stock price. During periods of economic growth, consumers tend to have more disposable income, which can lead to increased spending at restaurants like Chipotle. Conversely, during economic downturns, consumers may cut back on discretionary spending, potentially impacting Chipotle’s sales.

Impact of Recent Events

Recent events, such as the COVID-19 pandemic, have had a significant impact on Chipotle’s stock performance. During the early stages of the pandemic, Chipotle’s stock price declined as restaurants were forced to close or operate with limited capacity. However, the company quickly adapted to the new environment by investing in digital ordering and delivery services, which helped to drive sales growth.

Potential Risks and Opportunities

Chipotle faces several potential risks and opportunities in the future. One key risk is the ongoing labor shortage, which could lead to higher labor costs and operational challenges. Another risk is increased competition from other fast-casual chains, as well as from delivery platforms like DoorDash and Uber Eats.

On the other hand, Chipotle has several opportunities for growth in the future. The company continues to expand its store footprint, both domestically and internationally. Chipotle is also investing in new technologies, such as automated kitchens and digital ordering systems, to improve efficiency and enhance the customer experience.

Investment Considerations for Chipotle Stock

Chipotle Mexican Grill (CMG) is a popular fast-casual restaurant chain known for its focus on fresh ingredients and customizable menu. While the company has experienced significant growth in recent years, evaluating its valuation and potential for future profitability is crucial for investors.

Valuation Compared to Peers

Chipotle’s valuation can be assessed by comparing its key financial metrics to those of its peers in the fast-casual restaurant industry. Some of Chipotle’s key competitors include:

- McDonald’s (MCD): A global fast-food giant with a broader menu and lower average price points.

- Starbucks (SBUX): A coffeehouse chain with a strong focus on beverage and pastry offerings.

- Panera Bread (PNRA): A bakery-cafe chain known for its fresh ingredients and customizable menu.

One common valuation metric is the price-to-earnings (P/E) ratio. Chipotle’s P/E ratio is typically higher than its peers, reflecting its premium pricing and growth potential. For example, in 2023, Chipotle’s P/E ratio was around 45, while McDonald’s was around 25 and Starbucks was around 30. This suggests that investors are willing to pay a higher price for Chipotle’s earnings, likely due to its strong brand recognition, consistent growth, and potential for expansion.

Growth and Profitability Potential

Chipotle’s growth and profitability potential are influenced by various factors, including:

- Expansion Plans: Chipotle has a strong track record of expanding its restaurant footprint, which contributes to revenue growth. The company aims to open new restaurants in existing and new markets, leveraging its brand recognition and strong unit economics.

- Menu Innovation: Chipotle’s focus on menu innovation helps attract new customers and retain existing ones. The company has introduced new menu items, such as the Carne Asada and Chicken Fajita bowls, and has experimented with limited-time offerings.

- Digital Ordering and Delivery: Chipotle has invested heavily in digital ordering and delivery, which have become increasingly popular among consumers. This channel offers convenience and allows the company to reach a wider customer base.

Chipotle’s profitability is also influenced by its focus on operational efficiency. The company has implemented initiatives to streamline its supply chain, reduce labor costs, and enhance its digital capabilities.